Agribusiness Finance

Financing solutions for agricultural enterprises from resources and equipment to seasonal cashflow

Some of our benefits

Cashflow

Versatility

Support

Flexible Terms

Cashflow

Versatility

Support

Flexible Terms

An overdraft is a great way to help you finance your short-term cash flow and working capital needs

A business revolving credit loan is a fixed monthly payment that allows you to borrow up to your original loan amount again, once you have repaid 25% of the loan

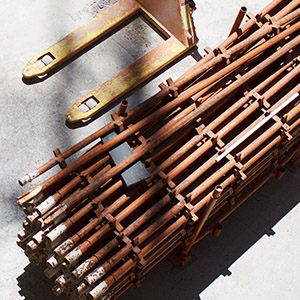

To finance all your farming vehicle and implement needs, we offer a wide range of packages to suit your business' cash flow and tax requirements

An Agricultural Production Loan (APL) is a short-term credit solution that allows you to upgrade and modernise your agricultural machinery and equipment

This loan is directed at commercial farmers with proven financial track records

Stanbic IBTC Bank Sector-focused Offerings

If you’re a large manufacturer, or a distributor of wholesale goods, Distribution Supply Chain Finance is the perfect solution for flexible loans to help maintain your cashflow.