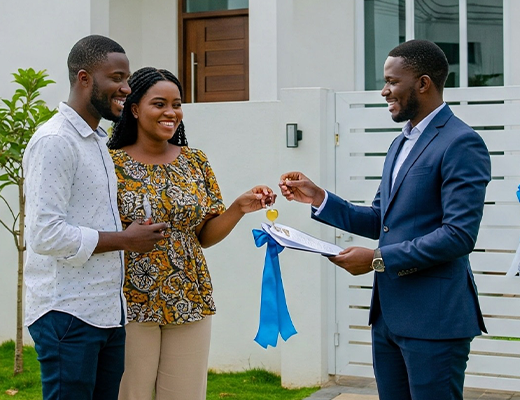

Apply for a Home Loan

Apply for a Stanbic IBTC Home Loan, a flexible home financing solution with monthly, quarterly, biannual, and annual repayment options.

Some of the benefits

Quick application

Easy terms

Expert assistance

Flexible instalment options

Home financing is available to all qualifying Nigerian nationals, both in-country and in Diaspora;

- Get financing for properties across a wide range of locations

- A repayment tenor of up to 20 years

- The option to purchase a completed residential unit from the developer of your choice

- The option to purchase an off-plan unit through any of our approved developers

- Your choice of monthly, quarterly, biannual or annual loan repayments

- The option to apply for a joint home loan with your spouse

Did you know that you can raise equity on an existing property using our equity release mortgage. Send an email to [email protected] to learn more.

Complete the Home Loan Application form or start your application online

You will also need:

- A valid offer of sale from the property seller

- A copy of the title documents to the property

- Last 3 months’ payslips

- Last 6 months’ bank statements with evidence of salary payment

- A copy of your valid photo identification (National ID, international passport or driver’s license)

- Letter of introduction from your employer stating your salary and confirmation status

- A copy of your company (work) ID card

- The valuation report from any of our approved property valuers

- Satisfactory search report

-

What you get

-

How to get it

Home financing is available to all qualifying Nigerian nationals, both in-country and in Diaspora;

- Get financing for properties across a wide range of locations

- A repayment tenor of up to 20 years

- The option to purchase a completed residential unit from the developer of your choice

- The option to purchase an off-plan unit through any of our approved developers

- Your choice of monthly, quarterly, biannual or annual loan repayments

- The option to apply for a joint home loan with your spouse

Did you know that you can raise equity on an existing property using our equity release mortgage. Send an email to [email protected] to learn more.

Complete the Home Loan Application form or start your application online

You will also need:

- A valid offer of sale from the property seller

- A copy of the title documents to the property

- Last 3 months’ payslips

- Last 6 months’ bank statements with evidence of salary payment

- A copy of your valid photo identification (National ID, international passport or driver’s license)

- Letter of introduction from your employer stating your salary and confirmation status

- A copy of your company (work) ID card

- The valuation report from any of our approved property valuers

- Satisfactory search report

If you’ve contributed to your Retirement Savings Account (RSA) for at least the last 60 months, you can apply for a Specialised Mortgage for Pension Contributors. You can also access any of our low cost mortgages using MREIF low-cost funds.

Got a question about our Unsecured Loan? View our commonly asked questions