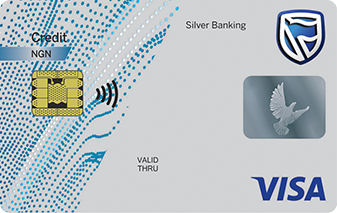

Visa Silver Naira Credit Card

The perfect companion, providing access to secure funds and as a selection of travel, shopping, dining and lifestyle opportunities.

N

1075

New Card fee

Up to 55 days

Interest free

3%

Monthly interest rate

Some of the benefits

Save

Up to 55 days interest free purchases

Perks

Exciting special offers for cardholders

Global

Get cash from any ATM worldwide

Convenience

Make repayments easily with Stanbic IBTC internet banking

What you get

- Gives you access to a revolving line of credit to pay for goods and services

- Accessible via POS and web (Local transactions only)

- Up to 55 days of interest free purchases

- Denominated in Naira and linked to a Naira account for repayment

- Chip and PIN enabled for optimal security

- Online protection for your web transactions with Verified by Visa®

- 3 year card validity

- Exciting offers and discounts when you spend locally.

- 24 hour contact center support

- You can make repayments easily with Stanbic IBTC internet banking

- Transfer directly from your Credit Card into your personal current or savings account within the bank.

What it costs

- Issuance Fee - N 1,075

- Free withdrawals at Stanbic IBTC ATMs, Other Banks ATM – N107.5 (for N20,000 and below) and N215 for withdrawals above N20,000 on Onsite ATMs. Maximum of N645 on Offsite ATMs.

- Interest Fees - 3% monthly

- Management Fee - 1% (+VAT) at issuance renewal and limit increase

- Penal Fees - 1% (+VAT) of overdue limit

- Daily Transfer Limit (NGN) - N500,000

- Daily ATM transactions - N150,000

- Daily POS transactions - N1,000,000

- Daily Web transactions - N500,000

How to get it

- At least 1 month salaried banking relationship with Stanbic IBTC Bank

- 6 months banking relationship with any other bank in Nigeria

- credit card application form

- Valid means of ID

- Proof of employment and address verification

- Salary domiciliation

- Available as a cash-backed credit card

-

What you get

-

What it costs

-

How to get it

- Gives you access to a revolving line of credit to pay for goods and services

- Accessible via POS and web (Local transactions only)

- Up to 55 days of interest free purchases

- Denominated in Naira and linked to a Naira account for repayment

- Chip and PIN enabled for optimal security

- Online protection for your web transactions with Verified by Visa®

- 3 year card validity

- Exciting offers and discounts when you spend locally.

- 24 hour contact center support

- You can make repayments easily with Stanbic IBTC internet banking

- Transfer directly from your Credit Card into your personal current or savings account within the bank.

- Issuance Fee - N 1,075

- Free withdrawals at Stanbic IBTC ATMs, Other Banks ATM – N107.5 (for N20,000 and below) and N215 for withdrawals above N20,000 on Onsite ATMs. Maximum of N645 on Offsite ATMs.

- Interest Fees - 3% monthly

- Management Fee - 1% (+VAT) at issuance renewal and limit increase

- Penal Fees - 1% (+VAT) of overdue limit

- Daily Transfer Limit (NGN) - N500,000

- Daily ATM transactions - N150,000

- Daily POS transactions - N1,000,000

- Daily Web transactions - N500,000

- At least 1 month salaried banking relationship with Stanbic IBTC Bank

- 6 months banking relationship with any other bank in Nigeria

- credit card application form

- Valid means of ID

- Proof of employment and address verification

- Salary domiciliation

- Available as a cash-backed credit card

We also offer