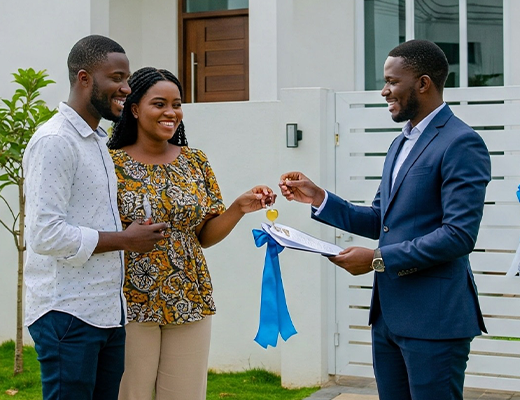

Stanbic IBTC MREIF Home Loans

Stanbic IBTC MREIF Home Loans is a specialized mortgage financing solution developed in partnership with the Ministry of Finance Incorporated (MOFI) Real Estate Investment Fund (MREIF) to support Nigeria’s affordable housing initiative. This product is tailored to help individuals—especially low- to middle-income earners—access long-term, low-interest home loans to purchase their dream homes. The Stanbic IBTC MREIF Home Loan aims to reduce housing deficit and promote inclusive home ownership empowering Nigerians to live a better life.

Some of the benefits

Quick application

Easy terms

Expert assistance

Flexible instalment options

Got a question about MREIF home loan?...view the commonly asked questions.

|

MREIF Home loan is also available to Nigerians in Diaspora

- MREIF Interest Rate: 9.75% p.a.

- Management Fee 1%

-

Advisory Fee 1%

- Legal Search on property documents (by bank-approved solicitor)

- Valuation of property (by the bank’s approved valuers)

- Perfection of title documents depends on the state valuation of property, size, location, and loan amount (to be advised)

- Life Insurance By the bank’s approved provider (with Stanbic IBTC Bank as first loss payee)

- Charting (for Lagos properties)

- Property Insurance By the bank’s approved insurer

-

Key Features

-

What it costs

-

Other charges (Subject to change)

-

How to get it

|

MREIF Home loan is also available to Nigerians in Diaspora

- MREIF Interest Rate: 9.75% p.a.

- Management Fee 1%

-

Advisory Fee 1%

- Legal Search on property documents (by bank-approved solicitor)

- Valuation of property (by the bank’s approved valuers)

- Perfection of title documents depends on the state valuation of property, size, location, and loan amount (to be advised)

- Life Insurance By the bank’s approved provider (with Stanbic IBTC Bank as first loss payee)

- Charting (for Lagos properties)

- Property Insurance By the bank’s approved insurer